Tether USDT Price Price Index, Charts

Contents

His first foray into the blockchain space was at Tether, later becoming CTO of exchange Bitfinnex for a year and a half. He is the founder of the Omni Foundation which developed the protocol used by Tether. Please also note that data relating to the above-mentioned cryptocurrency presented here are based on third party sources. They are presented to you on an “as is” basis and for informational purposes only, without representation or warranty of any kind. Links provided to third-party sites are also not under Binance’s control.

You can find others listed on our crypto exchanges page. Cryptoassets are highly volatile and unregulated in some EU countries and the UK. Live Tether price updates and the latest Tether news. When you return to goldprice.org the cookie will be retrieved from your machine and the values placed into the calculator. The spot price of Gold per Troy Ounce and the date and time of the price is shown below the calculator. USDT Price Prediction page — when deciding on your own price targets.

Yes, usually BTC goes up first, follow by ETH, Big caps and then smaller alts. Reeve Collins was the CEO of Tether for the first two years of its existence. Prior to that, he had co-founded several successful companies, such as the online ad network Traffic Marketplace, entertainment studio RedLever and gambling website Pala Interactive. As of 2020, Collins is heading SmarMedia Technologies, a marketing and advertising tech company.

Is it safe to keep money in USDT?

Additionally, because USDT is pegged to the dollar, its value should not be greatly affected by fluctuating markets. Overall, using USDT should be relatively safe, as long as you take basic precautions (like only using exchanges and wallets that you trust).

Tether’s history of lawsuits has also played a part in reducing demand for the crypto asset. When the New York Attorney General’s office first took legal action against the project, USDT was pushed off its dollar peg by 3%. As mentioned earlier, Tether tokens are created on several blockchains that have their respective native protocols/layers which allow for easy issuance and redemption of the USDT coins. Tether claims that each USDT coin is 100% backed by their reserves, which include conventional fiat currency , its cash equivalents, other assets and receivables from loans extended by Tether to third parties.

Check prices on YouHodler’s Tether wallet app and platform

Tether has agreed to provide regular attestations and audits of its reserves, which were found to be held in such risky investments as loans and other cryptocurrencies, instead of cash or cash equivalents. Tether was one of the first cryptocurrencies to peg its market value to a fiat currency. Tether, originally called “Realcoin,” valued each token at $1 to reduce the friction of moving real currency throughout the cryptocurrency ecosystem. It also issues a cryptocurrency tied to the price of gold known as tether gold, whose value is backed by physical gold bars. Tether is the world’s first and most popular stablecoin.

For instructions, check out How To Buy Cryptocurrency and Keep It Secure. The article is part of Kriptomat’s Learn project, which provides clear, brief explanations of crypto terminology and investing strategies. About Company We innovate with respect for both https://cryptolisting.org/ technologies and traditions.Company Stats Monthly data on the performance, community growth and volumes. « In our daily life, we all still need traditional financial services, but we do not want to miss out on opportunities opened by modern finance… »

Non-collateralized stablecoins do not have any collateral but work similarly to a reserve bank to maintain the required number of tokens, depending on the economic situation. Tether is a blockchain-based cryptocurrency whose cryptoсoins are backed by an equivalent number of traditional fiat currencies such as the dollar, euro, or Japanese yen, which are held in a specific bank account. Tether tokens, the native tokens of the Tether network, are traded under the symbol USDT. Tether is pegged to fiat currencies and reportedly gives holders the security of their assets always being backed by and interchangeable with the physical currency to which it is pegged. USDT was first pegged to and backed by the US dollar, followed by the Euro, Japanese Yen, Chinese Yuan, and reportedly the Mexican Peso. According to Tether, USDT can be traded for the fiat currency to which it is pegged without adversely affecting the digital ecosystem or risk losing its exchange rate value.

While the term Tether actually encompasses multiple tokens – USD , EUR , offshore Chinese Yuan and gold – it is commonly used to refer to USDT in particular. Speculations abound for how high Tether’s price will get in the future. Totals for Gold and Silver holdings including the ratio percent of gold versus silver will be calculated. The Holdings Calculator permits you to calculate the current value of your gold and silver.

For example, whenever the broader crypto market is experiencing a bull run, market participants favor volatile crypto assets, whereas in bearish phases they turn to the safety of stablecoins. Following the cryptocurrency market turmoil, the total supply of stablecoins has fallen quite significantly. This reportedly marks Q2 of 2022 as the first time in crypto history where the overall supply of stablecoins has decreased.

Brock Pierce is a well-known entrepreneur who has co-founded a number of high-profile projects in the crypto and entertainment industries. In 2013, he co-founded a venture capital firm Blockchain Capital, which by 2017 had raised over $80 million in funding. In 2014, Pierce became the director of the Bitcoin Foundation, a nonprofit established to help improve and promote Bitcoin. Pierce has also co-founded Block.one, the company behind EOS, one of the largest cryptocurrencies on the market.

Credited with ‘inventing the ICO’ to fund the project, Willett went on to implement his idea in the form of the ‘Mastercoin’. The Mastercoin protocol became the technological foundation of the Tether platform. Tethers exist on blockchains using the Omni Protocol, and as ERC20 tokens. Market cap is calculated by multiplying the asset’s circulating supply with its current price. The percent change in trading volume for this asset compared to 24 hours ago. The famously high volatility of the crypto markets means that cryptocurrencies can rise or fall by 10-20% within a single day, making them unreliable as a store of value.

Binance is not responsible for the reliability and accuracy of such third-party sites and their contents. USDT is a cryptocurrency that tracks USD’s price and will often face different financial regulations to USD in many jurisdictions. Any number of things could affect USDT’s value in the future, including changes to regulation, the rate of adoption by retail and institutional investors, and technological developments. Because unknown future events can affect the price, it is impossible to make a precise forecast.

VIEW Tether PRICES AT THE NO 1 GOLD PRICE SITE

Over the last 24 hours, a Tether is worth 0.01% more. Visit our currency converter page to convert USDT prices to currencies other than USD. Circulating supply shows the number of coins or tokens that have been issued so far. Popularity is based on the relative market cap of assets.

- YouHodler combines Tether price rates from Binance, Kraken, Huobi, OKEx, and others.

- The Tether price page is just one in Crypto.com Price Index that features price history, price ticker, market cap, and live charts for the top cryptocurrencies.

- Dollar, and is issued by a Hong Kong-based company of the same name.

- Tether I would like readers to comment there opinion Is it possible that crypto will end like this ❓❗ The largest stablecoin at the moment has drawn rumors since it hasn’t made its supporting documentation public.

For chart perspective , we broke the pannant , but we do have strong double ressitance , the trenline and the ichimoku weekly cloud. I think that we will make a fake out and we come back to the pannant eventually , unless we will… I’m an ALTCOIN holder so I’m biased towards an ALT season. Unfortunately, it does look like the BTC dominance will be breaking out of that downtrend starting early 2021.

News

Dollar, and is issued by a Hong Kong-based company of the same name. Summed up, it is a blockchain-based platform that aims to « modernize » money by issuing digital equivalents. Tether (₮) (USD₮) is a cryptocurrency with digital tokens designed to replicate the value of the United States Dollar. The theory is that this provides usdt chart protection from the volatility of cryptocurrencies, so 1 USD₮ will always be worth $1. To achieve this Tether claims to have each token backed 100% by actual assets in the platform’s reserve account. I think that this chart is very important , total market cap exclude the stable coins because we can consider them as cash !

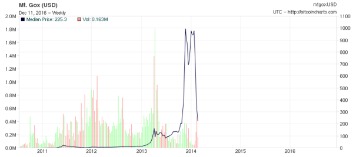

USDT hit an all-time high value of $1.32 in July 2018. The price swings occur when demand for the token changes. When the crypto market is surging, demand for stablecoins like tether is typically low.

However, Tether’s asset has seen some price fluctuations over the years. The current circulating supply of Tether is 68.18 Billions tokens, and the maximum supply of Tether is 68.18 Billions. This text is informative in nature and should not be considered an investment recommendation.

Who Are The Founders Of Tether?

Some of the most popular USDT wallets include Trezor, Exodus, Ledger and Atomic. While you cannot mine USDT, it is possible to stake or lend your USDT coins through various DeFi products and crypto platforms. Two original members of the Mastercoin Foundation, Brock Pierce and Craig Sellars, became co-founders of Tether. Former child actor, Brock was a minor partner in a digital entertainment network that raised $88 million in venture capital in the 1990s. In 2013, he joined brothers Bart and Bradford Stephens in founding the venture capital firm Blockchain Capital which was reported to have raised $85 million in two venture funds by October 2017. Over the last day, Tether has had 0% transparent volume and has been trading on 94,563 active markets with its highest volume trading pairs being .

USDT, on the other hand, is protected from these fluctuations. In addition to Bitcoin’s, USDT was later updated to work on the Ethereum, EOS, Tron, Algorand, and OMG blockchains. Circle aims to bolster USDC’s market position as competition with rival issuers Tether, Binance is heating up and decentralized finance platforms are crafting their own native stablecoins. There is no known maximum supply for Tether’s USDT, as new coins are issued based on user demand and reserves held by Tether. Like all cryptocurrencies, it was created with a fixed supply.

Can I transfer USDT to my bank account?

You can then proceed to withdraw your funds directly to your bank account: Tap “Withdraw” and enter the amount you would like to withdraw. Click on “continue.” and select the bank you would like to send your money to. Enter your transaction pin and click “find a match.”

Past performance is not necessarily an indicator of future results. CoinDesk is an independently managed media company, wholly owned by the Digital Currency Group, which invests in cryptocurrencies and blockchain startups. DCG has no operational input into the selection or duration of CoinDesk content in all its forms.

Tether’s current share of the entire cryptocurrency market is 6.33%, with a market capitalization of $ 68.20 Billions. In fact, the average daily USDT trading volume often equals or even exceeds the Bitcoin trading volume. This is especially true for exchanges where fiat-to-crypto trading pairs are not available as it provides a viable alternative to the US dollar.

When a billionaire entrepreneur tweets support for a particular coin or token, the price often goes up. More and more celebrities are promoting cryptos and NFTs to millions of followers on social media. The effects of these endorsements on crypto prices cannot be overstated. There are countless ways to analyze crypto performance and make a buying decision. Two of the most commonly used are technical analysis and fundamental analysis. The crypto market constantly changes, however, our interest rates are stable as ever.

More recently, in April 2002, Tether announced its launch on Kusama, a parallel blockchain network that serves Polkadot. The development proves that there’s ample interest in the USDT coin, amongst Polkadot developers. The stablecoin will power transactions occurring on the Kusama’s Statemine, a ‘public good parachain’ that helps in balance-keeping and deployment of non-fungible and fungible tokens across multiple blockchains. As USDT coins are minted on different networks, users must carefully check the destination address and make sure that they’re interacting with the correct blockchain before processing any USDT transfers.

The stated purpose of USDT is to combine the unrestricted nature of cryptocurrencies — which can be sent between users without a trusted third-party intermediary — with the stable value of the US dollar. Kraken has agreed to shut its cryptocurrency-staking operations to settle charges with the U.S. Securities and Exchange Commission , according to an industry source briefed on the matter.